1. TIPS FOR 1095-B Forms

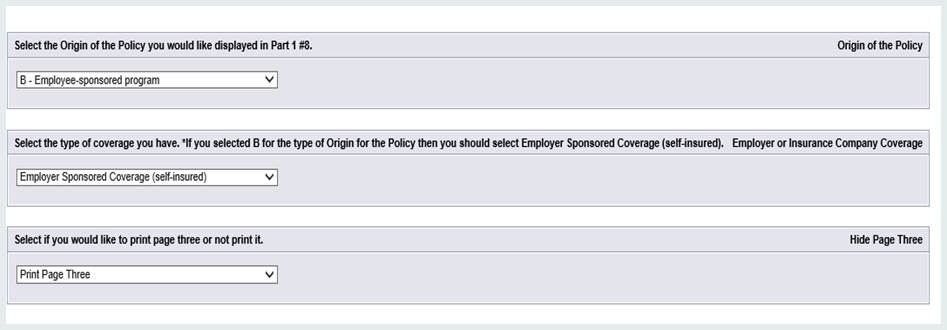

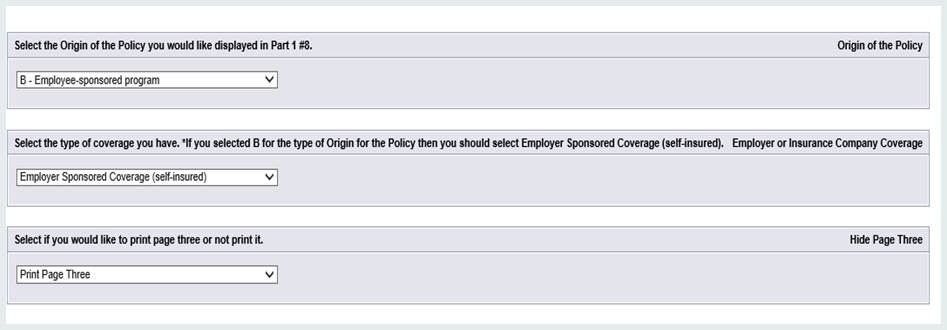

Parameter 1: “Select the Origin of the Policy you would like displayed in part 1 #8”

The item selected from this dropdown menu will determine what letter will appear in Part I, #8 of the 1095-B Form.

Parameter 2: “Select the type of coverage you have” If you selected B for the type of Origin, then select Employer Sponsored Coverage (self-insured)

•If you select “Employer Sponsored Coverage, Part III of the form will populate with your District Information.

•If you select “insurance Company Coverage, Part III of the form will populate with the Insurance Company’s Vendor Information. (The Vendor Information that will be used is tied to the Vendor Number used in the Deduction/Benefit Master records that are marked with an H in the “Garnishment Uses MWA” field.)

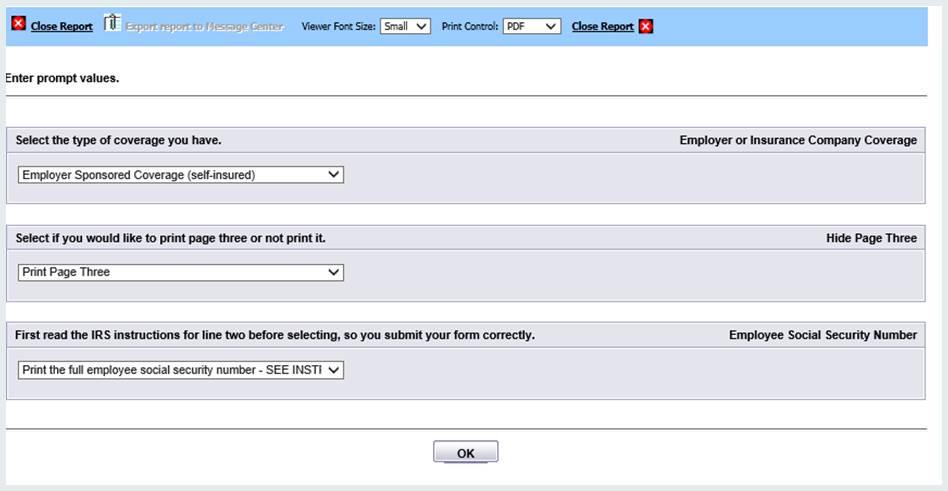

2. TIPS FOR 1095-C Forms

Parameter 1: Select the type of coverage you have:

•If you select “Employer Sponsored Coverage (self-insured)”, then an X will be placed in the checkbox in Part III of the 1095-C Form

•If you select “Insurance Company Coverage”, the checkbox in Part III of the 1095-C Form will remain BLANK

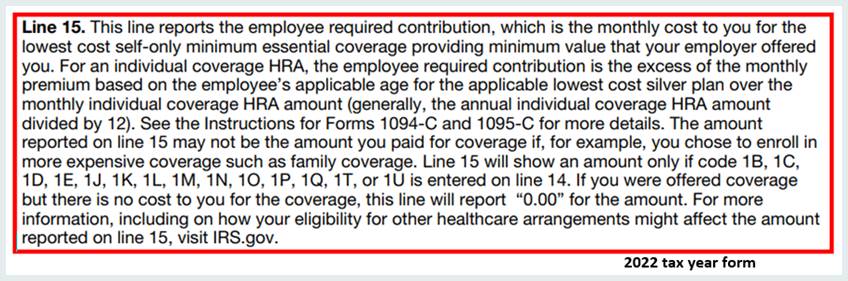

Line 15-Should an Amount appear?

If code 1B, 1C, 1D, 1E, 1J, 1K, 1L, 1M, 1N, 1O, 1P, or 1Q, is entered as Offer of Coverage on Line 14 either in the "All 12 Months" box or in any of the monthly boxes, then line 15 should include the amount of the Employee Required Contribution, which is, generally, the employee share of the monthly cost for the lowest-cost, self-only minimum essential coverage providing minimum value that is offered to the employee. .

•If you used 1A as an “Offer of Coverage Code”, an amount will NOT appear on Line 15, per IRS Guidelines.

•If you feel an amount should appear on Line 15 for an individual’s 1095-C Form, please review the IRS Guidelines and review the “Offer of Coverage Code” assigned to the individual.

Verbiage from IRS Instruction for Form 1095-C