Revised: 9/2020

The purpose of this option

is to allow for the payment of liabilities at a future date based upon due date

of the invoice. This practice is common with collection and payment of insurance

premiums.

If there are deductions for which should not have automatic

payroll liability checks to be issued, there is a way to turn off this

process.

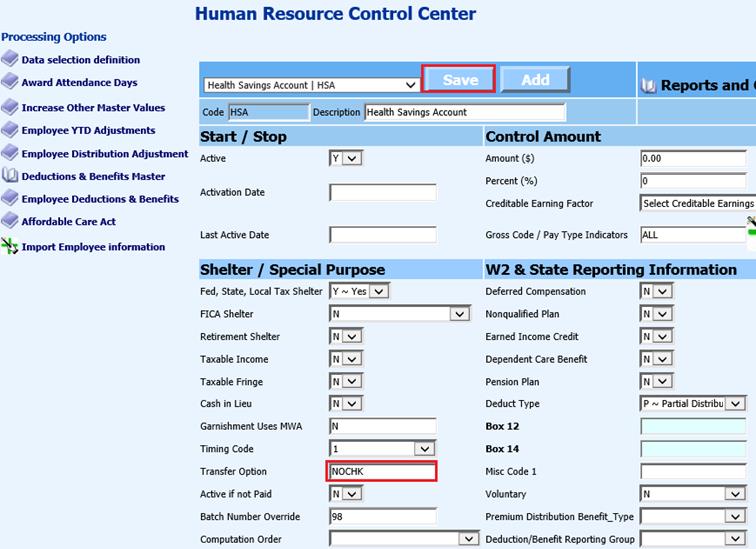

Using the “Transfer Option” field in the deduction master allows you to define whether a payroll liability check is to be automatically issued to pay your payroll liabilities, or held in a payroll liability account for payment at a future date.

1. Select Human Resources

2. Select Human Resources Control Center

3. Select Deductions & Benefits

4. Select Code

5. Transfer Option: Enter “NOCHK”

6. Select Save

Note:

•If value is “Blank” or “NA” listed, it will allow a liability check to be issued when payroll liabilities are transferred from Payroll to the General Ledger.

•The deductions/benefits marked as “NOCHK” records will be printed on the payroll liability report ONLY while the payroll remains open. These deductions/benefits will appear on the report; however they will not be automatically transferred to accounts payable for disbursement.

•When the payroll is closed, the Payroll Liabilities Report will ONLY show the items that WILL generate checks. The NOCHK items will NOT show on the Payroll Liabilities Report after the payroll is closed.

•A recommendation would be to print the Payroll Liabilities report while the payroll is OPEN and then again when the payroll is closed. While the payroll is open, the report will show all deductions/benefits that were computed with the Payroll. After the payroll is closed, the report would show all items that were posted to A/P for payment of deductions/benefits (excluding NOCHK items).

•The appropriate payroll liability will still post as part of the payroll transaction.