Revised: 5/2022

1. Select Human Resources or Payroll Processing

2. Select Add Change Employee Information

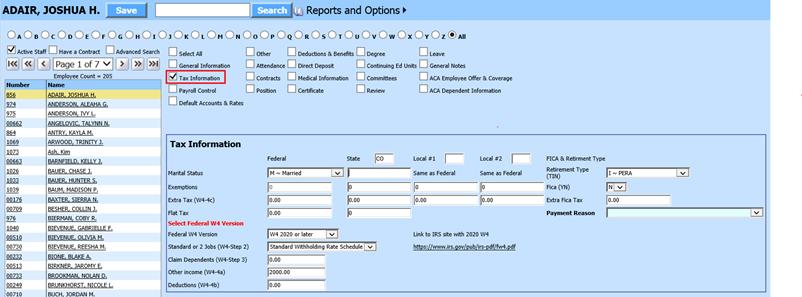

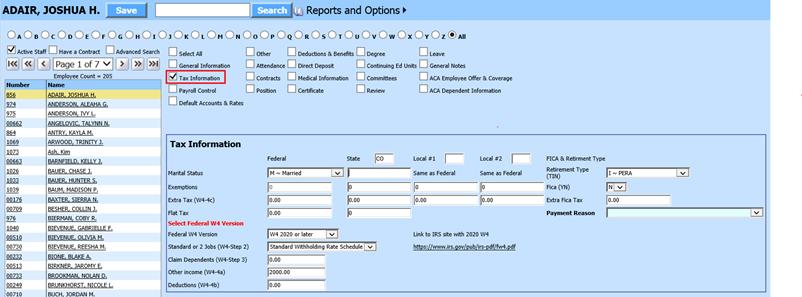

3. Place a check in Tax Information

4. Select the Employee from the employee list at the left side of the screen

o Marital Status: Enter employee W4 information

o Exemptions: Enter employee W4 information

o Extra Tax (W4-4c): Enter employee W4 information

o Flat Tax: Enter employee information: See following link for more information on Employee Flat Tax: http://help.schooloffice.com/financehelp/#!Documents/enteringanemployeeflattax2.htm

o FICA & Retirement Type:

§ Retirement Type (T/I/N): Enter the Retirement Selector for the contract.

§ T: See your specific state Retirement codes

§ I: See your specific state Retirement codes

§ N: No Retirement

o Fica (YN): If the Employee Contract is subject to FICA, select “Y”

o Extra Fica Tax: Enter employee extra Fica tax information

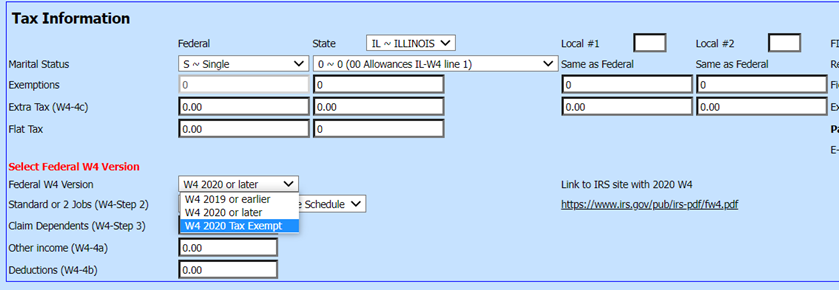

o Select Federal W4 Version: See following link for more information on 2020 W4 changes: http://help.schooloffice.com/financehelp/#!Documents/2020w4changes.htm

§ Federal W4 Version: Select version needed

*Exempt from Federal withholding? Choose “W4 2020 Tax Exempt from the drop down box titled “Federal W4 Version. State exemptions entered above will still be applicable

§ Standard or 2 Jobs (W4-Step2): Enter employee 2020 W4 information

§ Claim Dependents (W4-Step3): Enter employee 2020 W4 information

§ Other income (W4-4a): Enter employee 2020 W4 information

§ Deductions (W4-4b): Enter employee 2020 W4 information

5. Select Save