Revised:

10/2020

Setting up the Fixed Assets for GASB 34 Reporting

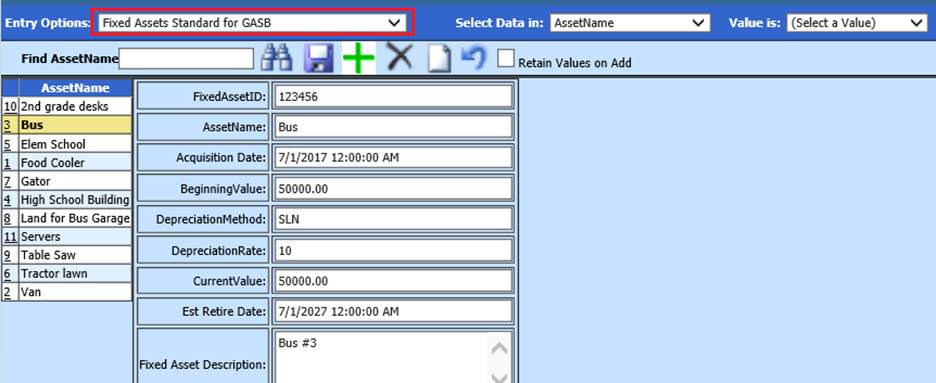

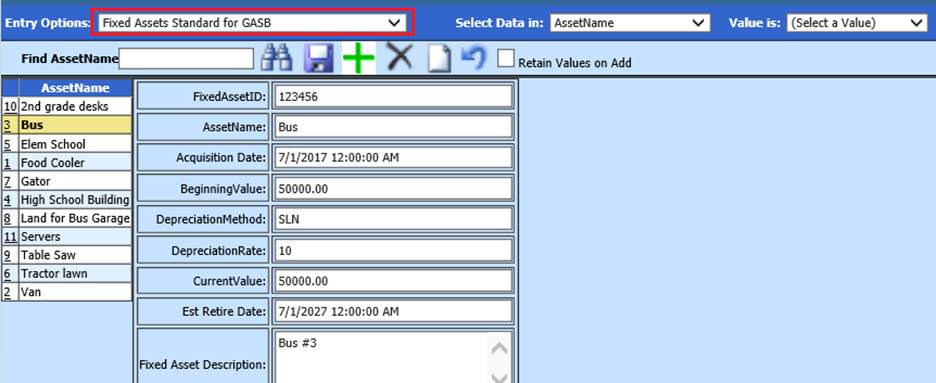

The GASB 34 setup in the Fixed Assets area of the system will allow the production of reports that will show the assets information such as acquisition date, beginning value, depreciation rate, depreciation and the accumulated depreciation. To enter Fixed Assets for the GASB 34 reporting follow the below steps.

1. Select Master File and Code Entry Options

2. Select Master File Vertical Data Entry and Changes

3. Entry Options : Fixed Assets Standard for GASB

Below is a list of fields that are required to be filled in before the system is able to process the GASB 34 report correctly

•Fixed Asset ID: This is the ID that you have assigned to the fixed asset item

•Asset Name: The name of the asset.

•Acquisition Date: This field represents the date the asset was purchased

•Beginning Value (Original Cost): This field is the original purchase price of the asset item

•Depreciation Method: This field for each item is “SLN”. This allows the system to calculate the depreciation method using the straight line depreciation method.

•Depreciation Rate: This field represents the numbers of years the item will be placed into service. Example: 5 for 5 years, 7 for years or 10 for ten years of service.

•Estimated Retirement Date: – This field is the date you estimate the fixed asset will be retired from service. An example would be to take the “Acquisition Date” plus the amount of years in the “Depreciation Rate” field to come to the date the item will be retired from service. If the item is purchased on 6/30/2008 and the depreciation rate is for 10 years. The estimated retirement date will be 6/30/2018.

•Asset Category: In this field you need to enter in the asset category.

The asset categories are listed below.

L = Land and easements

B =

Building

E = Equipment

M = Machinery

V = Vehicles

I =

Infrastructure (roads, bridges, sewers, dams, lighting systems, sidewalk systems

and tunnels)

•Date Retired: This field is only filled in when the item is actually retired. Once a date has been entered into this field the system will stop calculating depreciation on this asset.

•Salvage Value: In this field you need to enter in the amount you feel the asset will be worth at the estimated retirement date

•Gov or NonGov: This field needs to be filled in with either a “0” or a “1”. A “0” means the fixed asset item is a Governmental asset and a “1” means the items is a Non-Governmental asset or a “Propriety Fund” Asset.

4. The next group of fields are not required but will help when creating the report and sorting the report.

•Class Code: This field is the function or program number of the account number that was used to expense the item when it was purchased. This field can be used when producing the GASB 34 report. The report can be sorted by Government or Non-Government Assets and then by function or program.

•Account Number: This is the account number that was used when the item was purchased.

•The next group of fields “Make, Model, Model Number, and Serial Number” are all fields that describe the fixed asset item. Depending upon the information you have on the item some of these fields may or may not be used.

•School: This field is used to distinguish which school in the district the asset was purchased for.

•Department: This field is used to determine what department the item was purchased for.