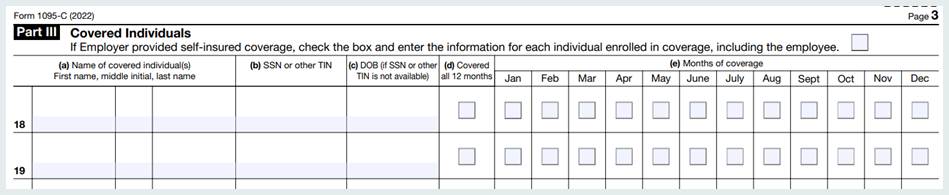

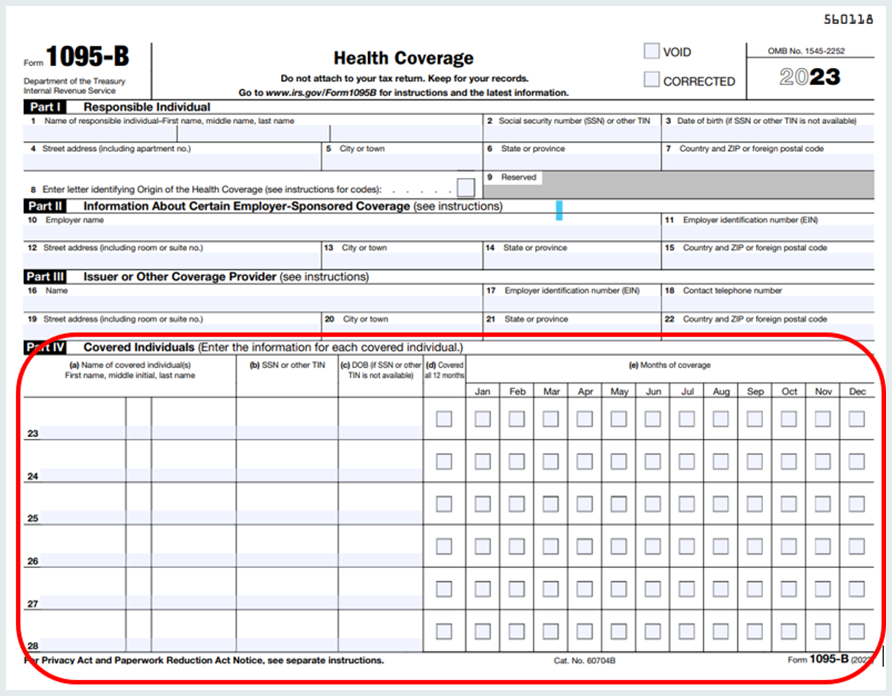

This section will cover the three different ways you can enter employee dependent’s data into SDS for the 1095-B and 1095-C forms. You can choose to use one option or all options , described below, to get this data entered. The dependent information is printed in Part III of Form 1095-C and in Part IV of Form 1095-B. On 1095-B, if an employee has more than six dependents, they will print on the third page of the form, “Covered Individuals-continuation sheet”.

Three ways to enter dependents/covered individuals:

• Option 1 = Manual Entry using ACA Dependent View

• Option 2 = Import from CSV or XLSX

• Option 3 = Employee Portal

NOTE: Before entering dependents, verify that your situation requires it. Not all 1095C forms will require dependents to be added. See form instructions for Part III, Covered Individuals lines 18-30, on page 4, for more information.

Questions about the form click this link:

1095-C form link: https://www.irs.gov/uac/About-Form-1095-C

1095-B page 1 of 3.

Form resources on IRS.gov site:

• See link for full form. https://www.irs.gov/pub/irs-pdf/f1095b.pdf

• Questions about the form click this link: https://www.irs.gov/uac/About-Form-1095-B